By Neena Shukla, CPA, CFE, CGMA, FCPA, CTP

If you have a responsible estimating system, you would typically anticipate recovering all of your direct costs. However, to ensure recovery of your Company’s indirect costs, requires a good budgeting process and established internal controls.

Step 1 – Establishing a Direct Cost Baseline

The first thing that is needed is a baseline level of direct cost effort that is anticipated, that will need to be supported by your indirect costs. Some of your direct cost requirements will be attributed to existing contractual efforts, while others will be the result of outstanding proposals or potential proposal/contractual efforts that you have some level of confidence that you will be awarded and others that are completely unexpected.

You need to assess the direct labor requirements and whether it can be provided by existing resources or require new personnel. Some of the questions you may need to answer are as follows:

If so, what skillsets and resulting pay-scales will be needed?

Will you need to subcontract some of the efforts required and if so, will it be supporting internal direct labor efforts or an outsourcing of a major portion of the required contractual efforts?

Will travel be necessary and how many trips, to where, for how long and for how many?

If performance requires direct materials do you have an established Bill of Materials?

Will you need to pay established commercial prices or need to locate potential sources and negotiate prices?

Answers to these questions and others, require you to understand both your organizations abilities and future capabilities.

Step 2 – Defining the Level of Indirect Support Required

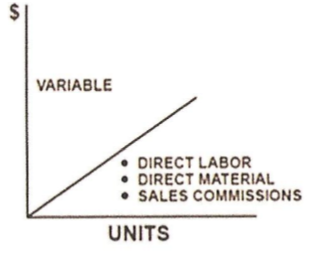

Once your direct cost activity level is determined you will need to establish your required indirect support expenses relative to the projected revenue/direct cost activity projected. Indirect expenses generally fall into three behavioral categories: variable, fixed and semi-variable. Variable costs increase or decrease with the change in the level of direct cost activity. A truly variable cost remains the same per unit (i.e., per dollars or per hours) of direct cost and changes proportionately, increasing or decreasing, with change in the volume of associated units of direct cost.

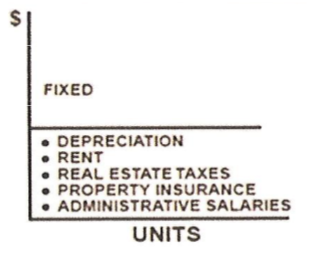

Fixed costs are, as the name implies, fixed in amount irrespective of the level of direct cost activity.

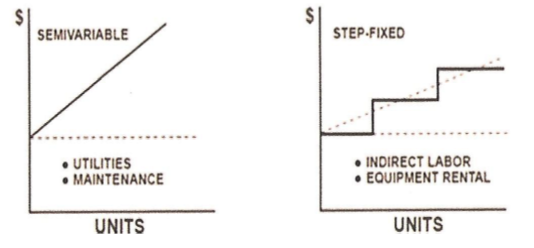

Semi-variable costs contain both fixed and variable cost elements that, in total, do not change in direct proportion to an associated direct cost. The fixed portion of a semi-variable cost is incurred if there is no production or business generated (i.e., phone or internet costs). For the purpose of budgeting the fixed portion must be segregated from the portion that is variable.

You will need to project each of your expenses based on historical actuals or estimated performance as variable, fixed or semi-variable (semi-fixed) so that you establish a baseline from which to monitor each of your expenses actuals and manage their overall performance to ensure maximum cost recover and maximum profit.

Step 3 – Indirect Billing/Pricing Rate Development

To establish indirect cost billing rates this process should represent your anticipated cost performance for the entire coming fiscal year/period (FAR 31.203(g)). For forward pricing rate purposes each indirect expense along with the associated direct costs need to be projected for all years that include proposed contractual effort. In an effort to keep your billing and pricing rates as close to actual performance as possible you will need and as the associated direct effort baseline fluctuates you will need to adjust your resulting indirect expense projections and resulting indirect rates for the applicable fiscal period to ensure complete recovery of your indirect expenses.