By Dwight Buracker, CPA, CVA

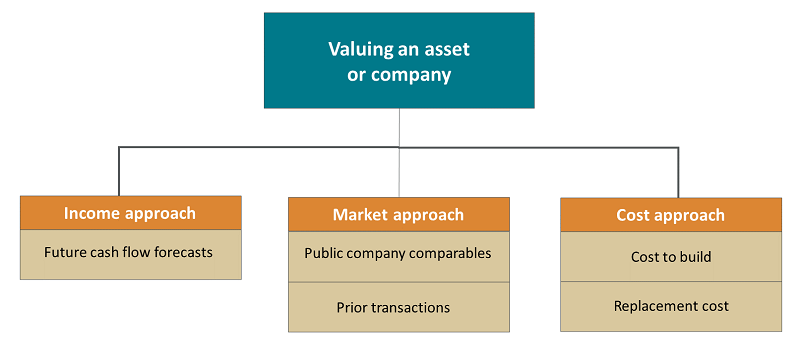

There are three ways to approach calculating a company’s value. Within each approach, commonly accepted methods exist that can be used in determining the value of a business.

Understanding each approach enables the valuation expert to elect the most effective valuation method and to ensure the valuation is performed correctly.

The Business Valuation Team at PBMares put together a 4-part series to help you navigate and better understand the entire valuation process.

This article highlights the following three methods used in valuing a company:

- Income approach

- Asset approach

- Market approach

Income Approach

The income approach relies on the idea that a company’s value is determined by the current value of future cash flows. Under this method, value can be forecasted using various scenarios.

Although undertaking the income approach requires highly detailed information and extensive analysis, this method often results in a very accurate appraisal.

Common methods used under the income approach include:

Capitalization of Earnings/Cash Flows Method

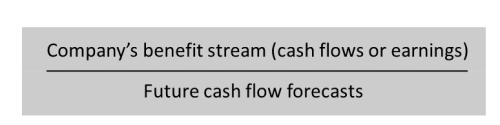

The capitalization of earnings/cash flows method is appropriate when the organization is expecting long-term, stable cash flows for the foreseeable future.

Under the capitalization of earnings/cash flows method, the valuation team uses recent results of the company as a proxy for future operations.

In this single-period valuation model, the organization’s value is calculated as follows:

Discounted Cash Flow (DCF) Method

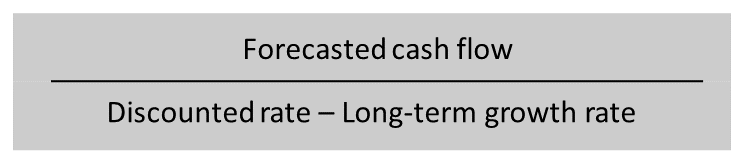

The DCF method is appropriate when the organization is expecting historical results do not accurately reflect future operations.

Under the DCF method, the valuation team uses forecasts or projections provided by management.

This method relies on the theory that an organization’s value equals the present value of its projected future benefits over a specified time, plus the present value of its residual value.

In this multiple-period valuation model, the organization’s value is calculated as follows:

What Are the Drawbacks of the Income Approach?

- Requires extensive detail and analysis.

- Relies heavily on assumptions.

- Of the three methods, the income approach presents the highest risk that the outcome of the valuation model will be inappropriate.

Market Approach

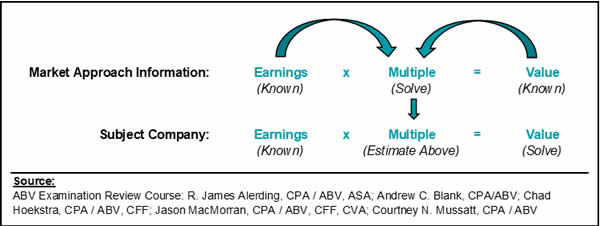

Common in mergers and acquisitions, the market approach generates a valuation by comparing similar companies.

With the market approach, a valuation expert will analyze and incorporate recent sales or even offer prices of similar organizations to determine value. Similar to how the market drives real estate transactions, the market approach considers a variety of sales components of similar sales transactions to arrive at a valuation multiple.

The components involved include:

- Transaction multiples derived from earnings

- Value information provided to various databases that consolidate public company information (e.g., Bloomberg)

Of course, no two organizations are identical, so valuations are commonly adjusted to “true up” the differences among the organizations in question.

What Are the Drawbacks of the Market Approach?

- The market may not be active enough to provide reliable sales data on comparable organizations.

- Credible sources to independently verify value can be difficult to locate.

- When valuing large, complex organizations, proper analysis of similar transactions can present a challenge.

- Information about economic factors that influenced the buyer’s decision might not be available in public records.

- Even if all the necessary information is readily available, properly adjusting the value is subjective and can be difficult to support or defend.

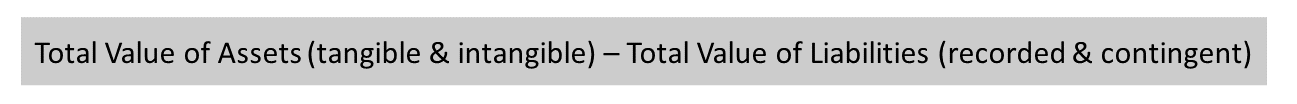

Asset Approach (aka Cost Approach)

Under this approach, value is determined as follows:

Adjusted Net Asset Method

This common method is appropriate when:

- A holding company or a capital-intensive company is generating losses

- A company’s net income or cash flows indicate a value lower than the company’s net asset value (sometimes also called “floor value”)

This floor value represents the net amount realized if the company’s assets were sold and its liabilities satisfied.

What Are the Drawbacks of the Asset Approach?

This approach requires an extensive amount of highly reliable data, including accurate cost calculations related to equipment, materials, labor, etc. Obtaining and/or developing this type of data can be time and labor intensive.

Learn More

Valuation can be a controversial and complex process. Take action to make the process manageable.

PBMares’ Business Valuation Team provides clients with objective and independent analyses of value covering a broad spectrum of needs.

From financial and tax reporting to litigation support for complex valuation situations, leverage the extensive experience of our expert team to provide an accurate assessment of value for your business.