Not-for-profits are finally able to make sense of the confusion over the Financial Accounting Standards Board’s (FASB) new revenue recognition, Topic 606, thanks to a new standard issued June 21.

FASB’s exposure draft issued last March left many in the not-for-profit community asking for more concrete examples and illustrations to be included within the new Accounting Standards Update (ASU), which was released as ASU 2018-08. While stakeholders viewed the first draft as beneficial, the most recent ASU titled Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made includes the much needed missing information.

As a result, there are now 21 examples within ASC 958-605-55. These examples give guidance on:

- distinguishing contributions from exchange transactions,

- distinguishing between donor-imposed conditions and donor-imposed restrictions,

- determining whether a contribution is conditional,

- measurable performance-related barriers or other measurable barriers,

- promises to give, and

- industry-specific examples, including foundations, research grants, hospitals, universities, museums, homeless shelters and more.

For example, 958-605-55-17F describes certain required administrative tasks not directly related to a recipient receiving funds would not be indicative of a barrier that must be overcome (condition). Most grantors want annual reports, and since this administrative task is not related to the purpose of the agreement, the requirement is not considered a barrier to be overcome.

There are specific examples related to conditions and restrictions on a contribution. The limited discretion by a donor (condition) is much more specific than a restriction. For example, a grantor’s requirement to incur qualifying expenses in compliance with established rules and regulations (for example the OMB’s federal compliance requirements) would be an indicator of a donor-imposed condition. An example of a restriction is a grantor limiting which program the funds must be used for. From a high level, restrictions relate to where or when the funds are to be used, but conditions tend to limit how the activity is performed.

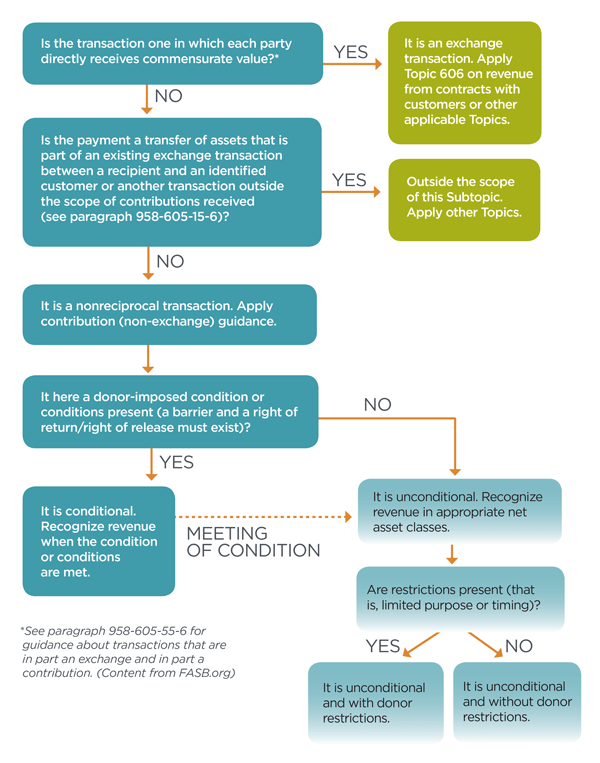

As a best practice to prepare for the revenue recognition changes in this new guidance as well as with Topic 606, every not-for-profit entity should evaluate their revenue streams, and consider if they will need to alter how they are recording revenue. This flow chart below (from the ASU) is a good starting point.

Not-for-profits with calendar year ends have to implement this new guidance in 2019 and those with fiscal year ends have to implement them in 2020. Don’t wait until it’s too late to fully understand the new guidance. Check with your tax advisor or contact PBMares to ensure your not-for-profit is prepared for implementation.