Source: RSM US LLP.

ARTICLE | October 04, 2021

Even as the housing market continues to lead the U.S. economic recovery, homebuilders, whipsawed by more than a year of dramatic changes fueled by the pandemic, are facing new pressures as they try to meet surging demand.

Already, builders have been scrambling to find enough workers to put up homes. But now, builders face an acute shortage of raw materials, putting the industry under additional pressure just to keep up with buyers’ voracious demand.

The squeeze is showing up in builders’ decisions of whether to start new homes at all. In August, housing starts and permits recovered slightly from dips in previous months, with total starts reaching 1.62 million annualized and total permits 1.73 million, up from 1.55 million and 1.63 million in July. But single-family starts were down for a second consecutive month, with 1.08 million, compared to 1.11 million in July, while permits remained unchanged at 1.05 million, according to data from the Commerce Department.

Much of this recent squeeze can be traced to the shortage of raw materials. Everything from steel to piping to gypsum to tiles is in short supply as builders scramble to secure limited supplies and, when they do, pay sharply higher shipping costs. Even lumber, despite its recent decline from its pandemic high, remains volatile and has increased to more than one and a half times what it cost before the pandemic.

And there are signs that these shortages will last longer than many believed even a few months ago.

Even as the easing of lumber prices has created opportunities for homebuilders, shortages and delays of other supplies and materials remain.

The homebuilder Lennar, for example, told investors in its fiscal third quarter earnings call on Sept. 20 that supply shortages were forcing it to build fewer homes and that its earnings would be affected.

“During the third quarter, our company and the homebuilding industry as a whole continued to experience unprecedented supply chain challenges which we believe will continue into the foreseeable future,” the company’s executive chairman, Stuart Miller, said.

Lennar is not alone. Pulte, Toll Brothers and D.R. Horton have issued similar warnings, saying that building product shortages are affecting their ability to complete homes, resulting in significant backlogs and extended cycle times across the industry.

In the end, the shortage is forcing builders to adapt in ways that were hard to imagine before the pandemic.

An industry playing catch-up

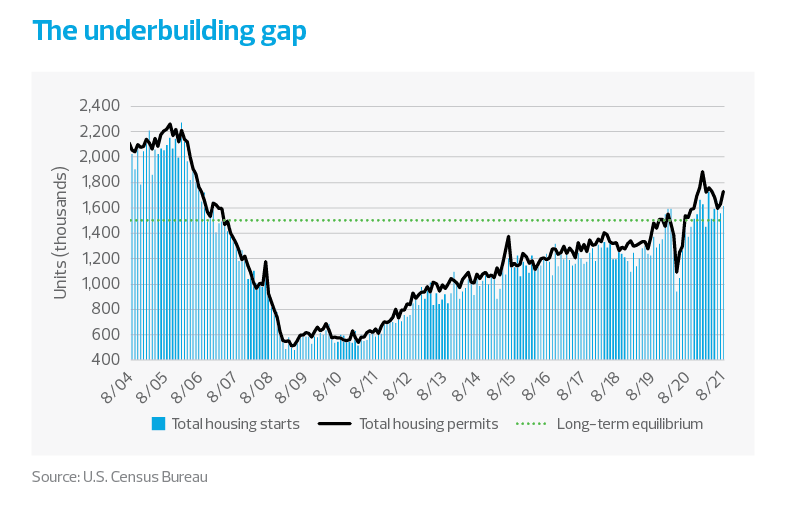

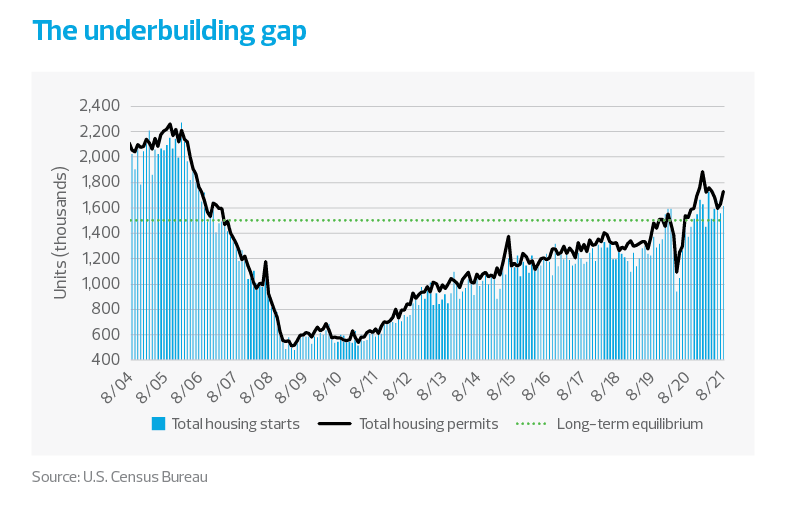

The gap in inventories has been building for some time. For more than a decade following the Great Recession, new housing starts and permits consistently fell significantly below 1.5 million annualized units, the amount considered necessary to sustain market equilibrium.

It all leaves the industry trying to play catch-up. A recent study by realtor.com estimated that the United States was short 5.24 million homes as of June. Despite the shortage of homes, housing starts and permits have not increased at the levels needed to begin to close the housing shortage gap.

Surging shipping costs

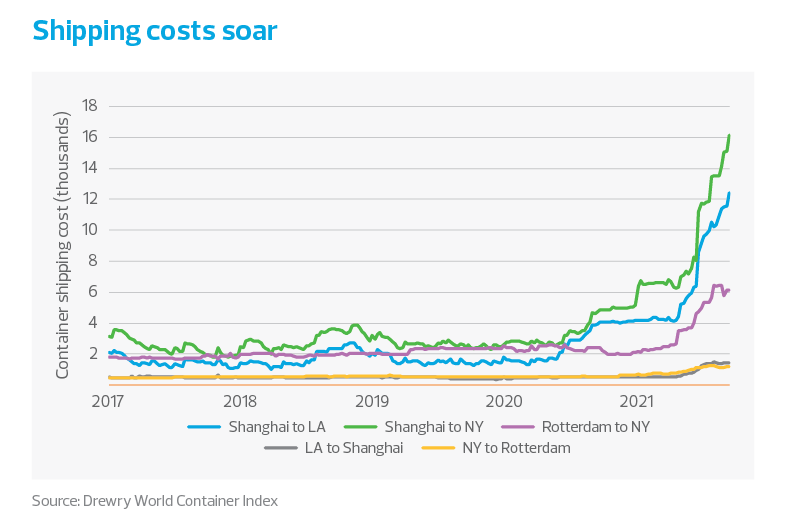

Adding to the pressure on builders is the difficulty of obtaining imported goods. Demand remains elevated across industries, helping to push shipping costs higher. The ports of Los Angeles and Long Beach had an average of about 860,000 inbound containers each month this year, 24% more than the typical monthly volume in the five years before the pandemic.

Some of the elevated demand can be traced to panic orders from companies nervous about running out of products; however, acceleration of online shopping has also had an impact.

The high demand for imported goods has caused significant delays in shipping, as logistics companies struggle to keep up with demand. As a result, shipping costs to the U.S. have skyrocketed, with costs from Shanghai reaching eight times their pre-pandemic levels.

Supply chain disruptions are expected to persist, as exporters continue to face halts due to the spread of the delta variant and pressures from increased demand as the holiday season approaches. These logjams are expected to continue to pressure prices higher.

As builders look to increase production of homes, they must manage customer expectations for delivery timelines and new home orders.

What is a builder to do?

Even as the easing of lumber prices has created opportunities for homebuilders, shortages and delays of other supplies and materials remain. Strategies that builders can pursue to weather this period include:

- Manage customer expectations: As a result of the labor and building product constraints, many builders have strategically slowed their home sales pace to more closely align with their current production levels.

- Consider other supply sources: When materials come from foreign sources, builders can be subject to economic shutdowns in other countries and to the higher shipping costs that are resulting from surging consumer demand in the United States. Sourcing goods domestically can offer some relief, even if limited, from these pressures.

Middle market takeaway

Supply chains remain fragile, and uncertainties will remain for the foreseeable future, as the world continues to be affected by the spread of the delta variant. As builders look to increase production of homes, they must manage customer expectations for delivery timelines and new home orders. These shortages will ultimately ease, but until then, a logical first step is to more closely align production goals with the ability to produce.

This article was written by Crystal Sunbury and originally appeared on 2021-10-04.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/economics/homebuilders-facing-material-shortage-cant-meet-soaring-demands.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International. The RSM(tm) brandmark is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.