You have a good budget, you think! But in reality, very little goes according to plan! It is essential that you continually monitor your indirect rate budget calculations and resulting billing and pricing rates to ensure that you are recovering your indirect costs to the maximum extent possible.

Budget variances, the difference between planned billing rates and planned forward pricing rates and actual performance, favorable and unfavorable, will happen. When they do, it is critical to profitability to understand what is causing the variance so that it can be considered in your budgeting process going forward or operationally corrected.

Base vs. Expense

It is quite easy to recognize that your direct cost base used for allocation of indirect costs has changed or that the level of indirect cost support projected is not what you anticipated, but the projection of your product or services costs are not established based on absolute dollar amounts of base or expense. Your pricing is established in a large part based on the projected percentage relationship of indirect support costs to the related direct cost projections. When the expected relationship does not prove out in actual performance you need to determine whether the indirect expense or the direct allocation base is at fault.

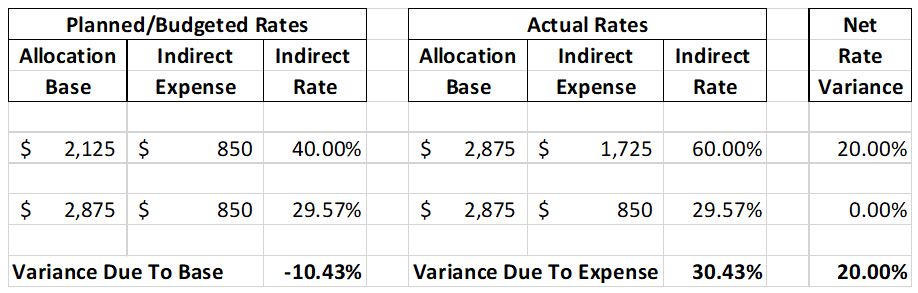

In the example below you see that the planned indirect rate was 40% and the actual rate turned out to be 60%. Twenty points higher. By comparing the planned level of expenses ($850) to the actual allocation base for the period ($2,875) you calculate an indirect rate of 29.57%. The variance between the planned indirect rate of 40% and the calculated rate of 29.57% is a reduction of 10.43% and represents the impact of an increased allocation base on your indirect rate. At this point, the increased allocation base has lowered your indirect rate from 40% to 29.57%. By comparing the actual indirect expenses of $1,725 to the actual indirect allocation base of $2,875 you get the actual indirect rate of 60.0% which is 30.43 percentage points higher than the planned indirect expenses indicating an increase in expenses has offset the impact of the higher allocation base increasing your indirect rate by 20 percentage points.

This calculation identifying the resulting increase or decrease in your indirect rates between changes in the allocation base or changes in the indirect expenses lets you know where you should concentrate your corrective action efforts. This analysis can be done at the macro-level (by entire indirect expense pool) or at a micro-level (by individual expense) when analyzing changes in your indirect rates.

Corrective Action

A favorable budget variance should not be ignored just because it is good. It is important to know what is working so that it can be improved and continued. Negative budget variances should be thoroughly analyzed. They may be the result of inaccurate budgeting, poor cost control, employee fraud, and/or decreased customer acquisition. Each issue requires the implementation of a different corrective action. Your budgeting and resulting pricing processes should be reviewed and improved where necessary to eliminate or minimize the risk of significant budget variances. The process, once reviewed and improved needs to be formalized through written policies and procedures to ensure it is carried forward.