In January 2022, the National Taxpayer Advocate provided its annual report to Congress, highlighting the struggles and challenges of the IRS. The Executive Summary or the Full Report can be found on the Taxpayer Advocate’s website.

Processing backlogs have led to long refund delays. The IRS was behind even before the 2021 filing season began, because it carried over approximately 11.7 million returns from 2020. It took until June 2021 before the IRS had processed virtually all 2019 returns. Then, in 2021, the IRS received approximately 17 million paper 1040 returns. Paper returns have been taking at least eight months to process, and in some cases much longer.

Business returns have also been subject to processing delays. At the close of the 2021 filing season, the IRS reported more than seven million business returns that required manual processing.

Telephone service was the worst it has ever been. Since the COVID-19 pandemic, call volume has skyrocketed and reached a historic call level, which made it even harder for taxpayers to receive assistance.

The IRS is taking even longer to process taxpayer responses to its notices. For many IRS programs, the typical processing time for taxpayer correspondence was 45 days. Based on practitioner feedback, processing time for some categories of correspondence has been running six months or longer. The IRS commented, “We’re getting mail, but it’s taking us longer to process it.”

The IRS had a backlog of more than 35 million returns at the end of the 2021 filing season. Millions of returns and amended returns remain unprocessed today.

Compounding Problems

A series of compounding problems over the years contributed to what the Taxpayer Advocate said was the “worst year ever” for the IRS.

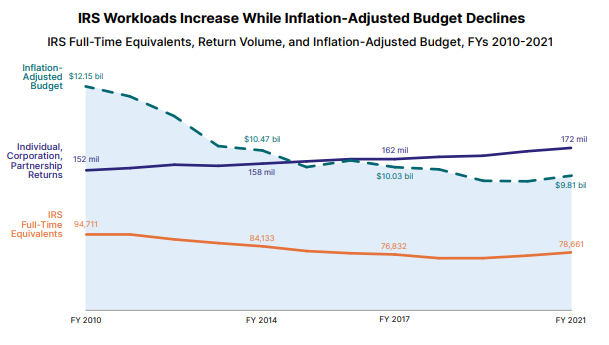

For one, the IRS’s workload has increased while the inflation-adjusted budget and staffing levels continue to decline. Since FY 2010:

- The IRS inflation-adjusted budget appropriation declined by about 20 percent;

- IRS staffing levels fell by nearly 17 percent; and

- The number of tax returns increased by 13 percent.

Another issue is that of money. While the agency struggled to process returns, issue refunds, and respond to correspondence, it received less than two-thirds of the money needed to modernize systems to efficiently process documents and respond to taxpayers.

Recruitment, hiring, and training are other significant challenges. Budget cuts, an aging workforce, and complicated hiring processes have left the IRS severely understaffed. The IRS needs more employees to improve customer service and bring in additional tax revenue. Current hiring is barely keeping up with the employees who leave or retire.

Finally, COVID-19 pushed the IRS past its limit. Trillions of dollars in 2020 alone moved through the U.S. government to provide immediate relief to struggling businesses, individuals, and families. Dozens of new and temporary tax laws were passed, which the IRS implemented – all while continuing to deal with underfunding, lack of staff, and outdated technology. “The IRS performed well under the circumstances,” said Erin Collins, National Taxpayer Advocate.

There is an initiative underway to hire 10,000 new employees rapidly, half of which will be positioned in IRS service centers around the country. Many new hires are expected to begin work this summer. The other half of new hires will be added throughout the next year.

Beyond new hires, the IRS is implementing online and voice chatbots, reallocating existing employees, and mandating employee overtime. It will also receive a six percent budget increase thanks to Congress’s omnibus spending bill; the amount is half of what was requested, though most of it will go towards improving taxpayer service.

Here are four ways the IRS could better serve taxpayers, according to PBMares Partner Tracey Powell.

IRS Suspends Mailing Notices to Certain Taxpayers

Another way the IRS is giving itself more time, and making life easier for taxpayers, is by suspending certain correspondence.

The IRS said on March 25, 2022, that it is suspending issuing several notices generally mailed to tax-exempt or governmental entities in case of a delinquent return. Due to the historic pandemic, the IRS hasn’t yet processed several million returns filed by individuals and entities. The notice suspension will help avoid confusion when filing is still in process.

Because of agency staffing issues and processing delays noted above, the IRS had been automatically generating delinquency notices for paper filed returns that the IRS received but had not processed. PBMares has had several clients receive these automatically generated notices, particularly Form 990T filers that mailed in their returns. The IRS is finally realizing that these automatically generated notices are only clogging up their systems with additional unnecessary correspondence and paper.

The suspended notices are:

| Number | Name |

| CP214 | Reminder Notice About Your Form 5500-EZ or 5500-SF Filing Requirement |

| CP217 | Form 940 Not Required – Federal, State, and Local Government Agencies |

| CP259A | First Taxpayer Delinquency Investigation Notice – Form 990/990EZ/990N |

| CP259B | First Taxpayer Delinquency Investigation Notice – Form 990PF |

| CP259D | First Taxpayer Delinquency Investigation Notice – Form 990T |

| CP259F | First Taxpayer Delinquency Investigation Notice – Form 5227 |

| CP259G | First Taxpayer Delinquency Investigation Notice – Form 1120-POL |

| CP259H | First Taxpayer Delinquency Investigation Notice – Form 990/990EZ |

| CP403 | First Delinquency Notice – Form 5500 or 5500-SF |

| CP406 | Second Delinquency Notice – Form 5500 |

The IRS will continue assessing the inventory of pending returns to determine the appropriate time to resume mailing these notices.

For taxpayers that still received one of the above notices, first check that the return was timely filed. If so, there’s no need to respond to the notice; in most cases, organizations need only wait for the IRS to catch up. Payment due dates for actual tax owed are still in place; it’s just that the paper reminders will cease temporarily.

While the IRS continues to work through its backlog and improve service, not-for-profit organizations and other taxpayers may still have ongoing issues with unprocessed returns, delayed refunds, and more. Ongoing questions or issues with IRS can be directed to Edward Yoder, CPA, MSA, Partner in the firm’s Not-for-Profit practice, or your PBMares tax representative.