Source: RSM US LLP.

ARTICLE

Estate planning is inherently complex, and the uncertainty surrounding the future of estate, gift, and generation-skipping transfer (GST) tax exemptions adds an additional layer of difficulty.

The challenge lies in the fact that these exemptions are not static; they are subject to legislative changes that can significantly alter the landscape of wealth transfer planning. This uncertainty makes it difficult for individuals to make informed decisions about their estate plans, as the rules governing these exemptions may change, affecting the tax liabilities associated with transferring wealth.

Currently, there is a window of opportunity for individuals to make large gifts or other transfers. However, it’s crucial to weigh the potential benefits against the risks. Consider your long-term financial goals and legacy aspirations when making these decisions.

What are the estate, gift and GST exemptions?

The lifetime exemption is the amount that individuals can transfer during their lifetime or at death to others without incurring a 40% tax.

For 2024, the lifetime exemption amount is $13.61 million per individual, or $27.22 million for a married couple. In addition to the estate and gift taxes, a separate generation-skipping transfer tax is levied upon amounts that skip a generation with similar exemption and phaseout timelines. The exemption amounts will increase to $13.99 million for 2025, according to unofficial projections.

What will happen after Dec. 31, 2025, if Congress does not act?

Absent any legislative action, the current temporarily increased exemptions are set to revert to pre-2018 levels on Jan. 1, 2026, adjusted for inflation. This means the exemptions will drop to amounts estimated to be around $7 million per individual or $14 million for a married couple. Final regulations issued by the IRS generally ensure that there will be no “clawback” for gifts in excess of the decreased exemption made prior to Jan. 1, 2026.

This is not the first time these exemptions have been on the brink of reduction. In 2012, the exemptions were set to expire, but Congress intervened at the last minute and ultimately extended the increased exemptions.

Some individuals who made gifts in 2012 solely for the purpose of utilizing the exemption later regretted their decision when the higher exemptions were ultimately extended. Learning from our past, it is important to weigh whether you would regret making certain transfers if the temporarily increased exemptions are made permanent.

How might the 2024 election results of the 2024 election impact the estate/gift and GST exemptions?

The outcome of the presidential and congressional elections probably will significantly impact these exemptions. While the presidential candidates have indicated the direction in which they hope to steer these policy issues, the balance of power in Congress will go a long way toward determining whether either party can advance its agenda.

Here’s a simplified view of the policy crossroads based on what the presidential candidates have indicated:

If Democrats sweep the White House, Senate and House of Representatives, the exemptions could be reduced or eliminated. Even with a Democratic trifecta, however, it’s possible that Congress could extend or modify the exemptions.

On the other hand, if Republicans sweep the White House and both chambers of Congress, there is a greater likelihood that the exemptions will be extended or increased.

In the case of a divided government, the policy outcomes would be more difficult to predict. And regardless of the power dynamics, the margins of majorities matter. Expect robust debate regarding these provisions in the 119th Congress, which begins in January 2025.

Notably, the nonpartisan Congressional Budget Office projects the cost of extending the exemptions would be about $167 billion between the end of 2025 and 2034. As a reference point, the government spent $6.13 trillion during fiscal year 2023.

What can you do to prepare?

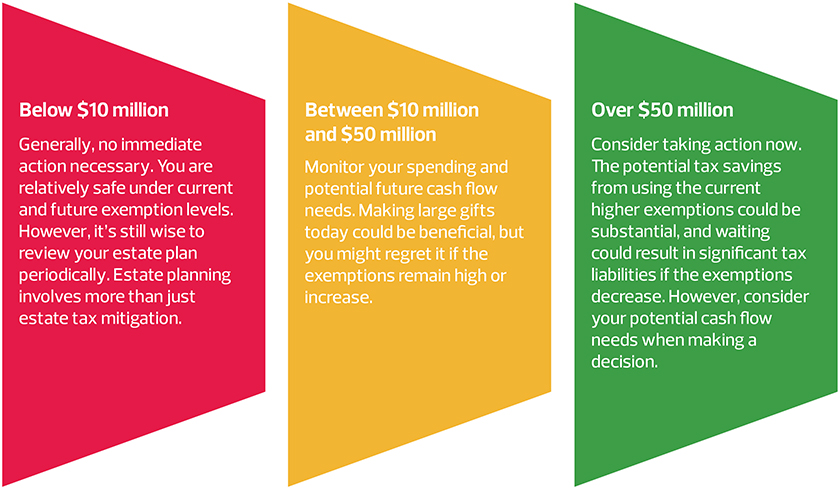

Given the uncertainty surrounding the future of the estate/gift and GST exemptions, it’s crucial to consider your options based on your current net worth and future financial plans. Here’s a general guide based on your net worth (per individual):

If you decide to take advantage of the current higher exemptions, it’s essential to act now.

Estate planning requires careful planning and timely execution. Depending on the circumstances, there may be multiple strategies to review with tax professionals, attorneys, and other advisors. An appraiser may need to value assets before the transfer.

In addition, an attorney may need to draft several estate planning and transfer documents. The closer we get to Dec. 31, 2025, the more difficult it will be to ensure that a holistic wealth transfer strategy is implemented based on your goals and circumstances.

Establishing trusts, such as irrevocable grantor trusts, can be an effective strategy for transferring wealth. However, there has been recent legislation and proposals to limit or eliminate the benefits of certain types of trusts, such as grantor trusts, including grantor retained annuity trusts. While there have been discussions and proposals, the specific details and the likelihood of these changes are uncertain.

The uncertainty surrounding the future of the estate/gift and GST exemptions necessitates proactive and informed planning. You can take preparatory steps—such as funding a trust to which you later sell assets, or executing documents and funding with a very small gift—in order to be ready to execute your estate planning strategies when there is more certainty. By understanding your current financial situation and potential legislative changes, you can make strategic decisions to protect your wealth and ensure a smooth transfer to your beneficiaries.

This article was written by Carol Warley, Andy Swanson, Scott Filmore, Amber Waldman and originally appeared on 2024-09-20. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/services/private-client/navigating-the-uncertain-future-of-the-estate-gift-and-gst-exemptions.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.