Moving You Forward

As you navigate this new business environment, leaders need the right guidance and direction to move forward. Tap into our customized tax, audit, accounting and business advisory solutions to help you recover from disruption and grow stronger. Contact a PBMares advisor today.

RECENT INSIGHTS:

State and local tax policy: 2024 preview

Highlights and need-to-know policy landscape as the 2024 state legislative sessions begin.

Understanding root causes of material weaknesses in internal controls

Companies are experiencing an increase in material weaknesses, and understanding potential root causes can identify corrective actions.

Tax Considerations for Military Contractors Working Abroad

Navigating the tax requirements for military contractors can be complicated. Learn about several key considerations for tax treatment and implications.

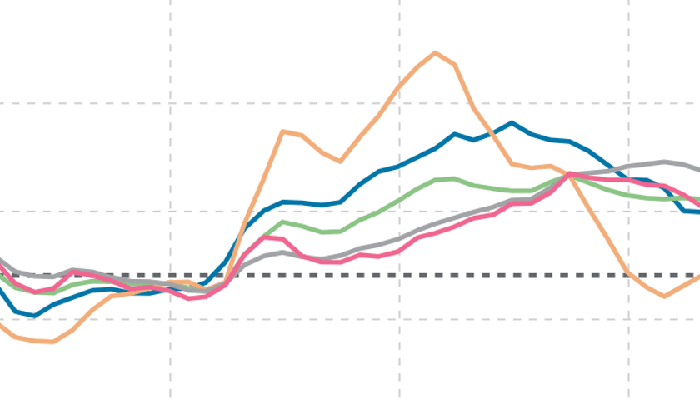

December CPI: Sticky service and housing prices illustrate the difficult last mile in inflation fight

Despite a three-month annualized top-line inflation pace of 1.8% and a six-month rate of 3.3%, prices in the service sector, which comprises 62%

Prepare Your Business as the High Estate Tax Exemption Expires

If your estate could surpass the lifetime estate exemption, learn about new guidelines that might justify a lower and more favorable valuation for tax reporting purposes.

Contracting Success: Year-End Financial Flourish for Savvy Government Contractors

Government contractors, learn about year-end financials and setting yourself up for success in the New Year.