Source: RSM US LLP.

ARTICLE | September 26, 2023

The American higher education system has undergone a rapid transformation over the past several years. The causes are varied and interconnected and include rising tuition costs, an evolving job market, and shifting cultural factors and demographics. There is palpable anxiety among higher education administrators, especially in smaller private, religiously affiliated institutions, as enrollments decline and operating costs continue to rise.

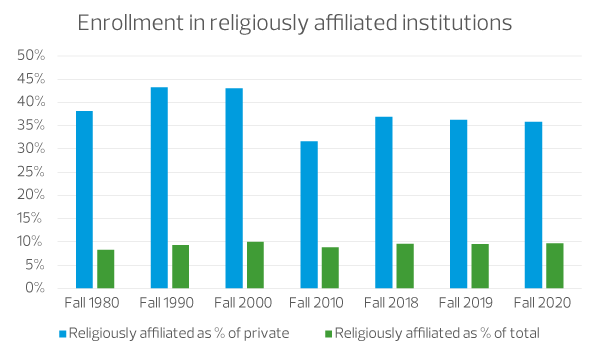

While predicting future enrollment trends involves a bit of speculation, a look at historical data can bolster the accuracy of projections. The National Center for Education Statistics (NCES) tracks, among other things, enrollment by student demographics and institution characteristics. It does not evaluate religiously affiliated institutions every year, but its statistics provide a baseline for analysis. Using a weighted average methodology, we can conclude that religiously affiliated enrollments have accounted for approximately 37% of private enrollment (ranging from 31.6% to 43.2%) and 9.4% of total enrollment (ranging from 8.3% to 10%) with relative consistency for several decades.

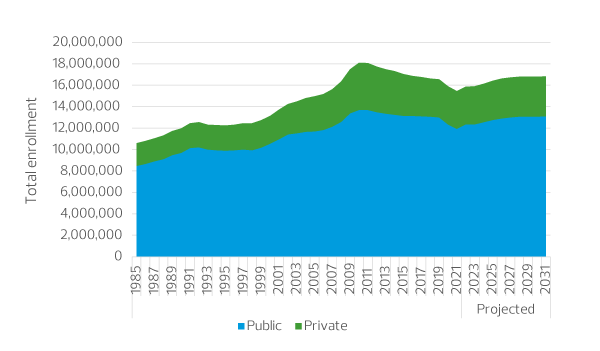

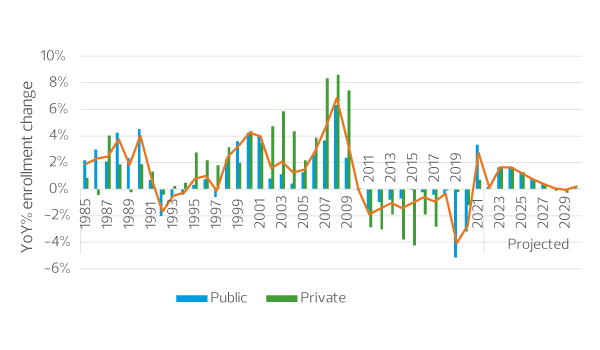

The NCES also projects future enrollment using its own methodology and currently provides projections through 2031.

Notably, the NCES projects an average of 0.9% annual growth in total enrollment for the next decade, with a steady 22.2% portion of enrollees attending private institutions in the projected years.

From 2023 to 2031, average enrollment growth is projected to be 0.6% per year among private institutions, and 0.7% per year overall. Given this data and the relative stability of religiously affiliated enrollment compared to other metrics in recent years, we compute a 0.6% average annual growth rate through 2031 for private, religiously affiliated institutions.

A stagnant pool

Such a meager growth projection for religiously affiliated institutions should give administrators serious pause. Enrollment mostly grew from the 1980s through the early 2000s but subsided in the 2010s, and despite showing signs of a rebound in recent years, meaningful growth will not likely occur again for some time—which may be a drastically different assumption than administrators’ current projections.

Historically, the growing pool of higher education enrollees allowed institutions to create capital and strategic plans that may no longer be viable in such a stagnant environment. Institutions will need to adapt to a more competitive landscape plan for lower enrollment for the longer term, or perhaps do both.

Leaning into competitive advantages

Higher education institutions that are most adaptable to this environment are most likely to maintain enrollment levels. Institutions should lean into their competitive advantages—what makes them unique and appealing—rather than follow what everyone else is doing. For many institutions, this is counterintuitive, and they chase trends in an effort to mimic others’ successes.

Religiously affiliated institutions especially need to focus on understanding what appeals to their core demographic; an institution’s religious affiliation and associated culture are often primary draws for potential enrollees. Even though the overall pool may be stagnant, many high school students contemplating postsecondary options will still prefer an institution with a religious influence.

These institutions should consider leveraging a variety of competitive advantages, including

- Campus culture: Educational institutions build communities as much as they teach young adults, and this can be a major factor for potential enrollees. Unique extracurriculars, lectures, religious services, and other activities have a significant impact on students’ educational experiences outside of the classroom.

- Alumni and legacy networks: Prospective students are often influenced by parents, mentors, or others who are alumni of a particular institution. Alumni can share their positive experiences and exert subtle (or unsubtle) influence over the next generation.

- Cost and financial aid: While not the primary decision driver for many students, competitive costs and the availability of financial aid can be a tipping point. Institutions that are fortunate to have endowments or lower-cost structures hold a distinct advantage.

- Post-educational opportunities: Ostensibly a primary reason to attend a higher education institution is for the professional paths and other opportunities afforded by a degree. Institutions that directly connect students’ academic experiences to tangible opportunities after graduation will be more appealing.

- International and part-time students: Institutions that welcome students from other countries or who are not enrolled in full-time programs should consider expanding offerings in these areas to help maintain, or even grow, enrollment levels.

- Additional or related brand offerings: Some institutions offer related services like a publishing house, private secondary institutions, or content production that enhance their brand and make them more recognizable to potential enrollees.

- Online education: While this field has become extremely crowded, leveraging key faculty or course content to reach a broader audience could boost enrollment.

Naturally, not all religiously affiliated institutions will have competitive advantages in all (or even most) of these categories. However, they should take stock of their current student and alumni bases to understand the factors that contribute to enrollment decisions and lean into the advantages they can offer rather than follow the crowd.

Source: RSM US LLP.

Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/industries/nonprofit/religiously-affiliated-universities-must-plan-for-the-future.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.