COVID-19 has transformed every aspect of the real estate industry; some sectors have experienced surges in demand while others are looking at ways to stay relevant. All the fluctuations are having a predictable impact on real estate value, but that’s as far as the predictions go. The full impact on the relative value of the real estate is still being assessed and analyzed.

What Is a Cap Rate?

One of the key measures used in appraising real estate value is the capitalization rate or cap rate. A property’s cap rate is the expected rate of return, which is found by dividing net operating income by the current market value of the property. Net operating income is the property’s annual income less expenses, which include maintenance and upkeep as well as taxes. The resulting cap rate is a percentage that investors use to determine the potential future profitability of their real estate investment based on the annual return.

This method is somewhat limited in practical application because it works best on cash-only purchases and applies to the first year of ownership, post-purchase. If investors buy the property with a loan, or the market is tumultuous and occupation levels suddenly drop, the cap rate is less reliable.

Nevertheless, it’s a quick and common method of determining an asset’s value, as well as comparing the purchase price with similar properties. A cap rate is one way to figure the amount of risk in a potential real estate investment. In simplest terms, a higher cap rate tends to indicate higher risk and lower returns, and a lower cap rate tends to indicate lower risk and higher returns. This isn’t always the case and there are no true ‘good’ or ‘bad’ cap rates. Several other factors affect the potential rate of return, like:

- Age and location of the property

- Type of property

- Tenants’ financial positions

- Tenant leases

- Other external factors, like tenants’ business conditions and the economy as a whole

To the last point, the pandemic has made estimating future profitability, even a year out, a challenge for real estate investors, owners, and developers.

Impact of COVID-19 on Cap Rates

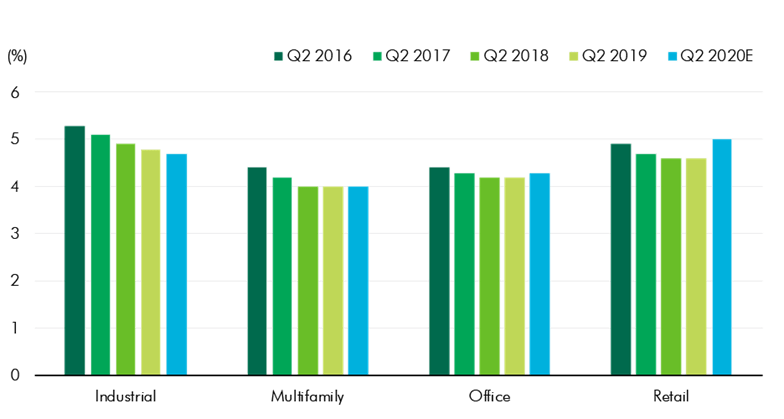

Early on in the public health crisis, some experts predicted that cap rates would increase because of market volatility, uncertainty, and lower U.S. Treasury yields. Multifamily and residential housing, despite tenant financial pressures, was expected to display less volatility than other sectors. Net operating income of hotels dropped sharply to its lowest point in two decades in the second quarter, with a recovery expected to take several years. REIT values dropped by as much as 60 percent between February and mid-May, and most of retail was projected to take a significant hit to property values.

Determining property value been a balance of seeing which transactions affect cap rates and how different property types respond to the market. According to CBRE, property values are expected to be 10 to 20 percent lower by the end of 2020, which would result in a “moderate rise” in cap rates, similar to what was predicted earlier in the year.

Mid-year data indicate that the industrial and multi-family sectors had indeed fared better and were more stable compared to other property types, including office and retail. Even by the third quarter, office deals were on the rise in September compared to August, according to data from NAIOP.

Image Credit: CBRE

In their forecast, cap rates could return to pre-COVID levels within about three years.

Determining Property Value Post-COVID

The typical methods of determining property values are changing thanks to COVID-19. In the short-term, and especially with struggling properties, calculating cap rates based on the average of five years of forward net operating income would be a more predictive model. For uncertain sectors like retail and hospitality, using a more detailed approach like discounted cash flow analysis can yield a more accurate measure of value. Real estate sectors doing reasonably well, like housing, industrial, and to a degree, even the office sector, could still potentially use the straightforward cap rate valuation model. In either case, investors will want to carefully examine a property’s historical data more closely.

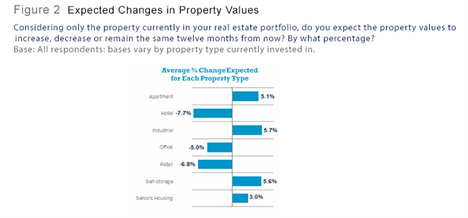

Source: National Real Estate Investor

As the chart above illustrates, some real estate sectors are poised to increase property value while others, somewhat predictably, are expected to decrease. Yet, in a survey conducted by National Real Estate Investor, many real estate investors still have access to capital and may look to increase holdings in the short-term as interest rates remain low.

The context of individual property value is also changing. While in the past it’s less risky if the tenants are financially solvent and pay their rent on time, the COVID environment has switched up which party is in control. At present, it’s a tenant’s market. Lease terms have been renegotiated and more building owners are offering rent relief measures, added safety precautions, and enhanced building technology.

Given market volatility and the need to consider a property’s value against its individual characteristics, investors, owners, and developers need to work with qualified valuation professionals who understand the nuances of the real estate industry. Determining property values is as much an art as a science, and knowledgeable insight can help anticipate risks and carefully evaluate an asset’s profitability potential.

Contact Jennifer French, Partner and Leader of the PBMares Construction and Real Estate Team for questions on changing cap rates and real estate value and Dwight Buracker, Partner and Certified Valuation Analyst for questions on valuations.